Does Renters Insurance Cover Storage Units?

We will search the top carriers for you for the best offer.

Does Renters Insurance Cover Storage Units? A Detailed Guide

Yes—renters insurance typically extends coverage to items stored off-site, such as in storage units. But it’s limited by sub-limits, exclusions, and your policy’s terms. Knowing how this works helps you avoid gaps and tailor your protection.

1. Does Renters Insurance Cover Storage Unit Contents?

Your renters policy includes off-premises coverage, meaning personal property is protected whether it’s in your apartment, on the road, or stored in a facility. Covered perils usually include:

Fire, theft, vandalism, wind or hail

Water damage from burst pipes

Smoke damage and other named perils

However, flood, earthquake, mold, and pest damage are excluded, just as they are at your residence.

2. How Much Coverage Do You Actually Get?

Coverage limits for storage units are typically capped:

Most policies cover up to 10% of your total personal property limit.

In many states, this is capped at $1,000, even if 10% exceeds that.

Example: If your renters policy covers $30,000 of personal property, you may only have $3,000 or $1,000 of off-premises storage coverage, depending on local laws.

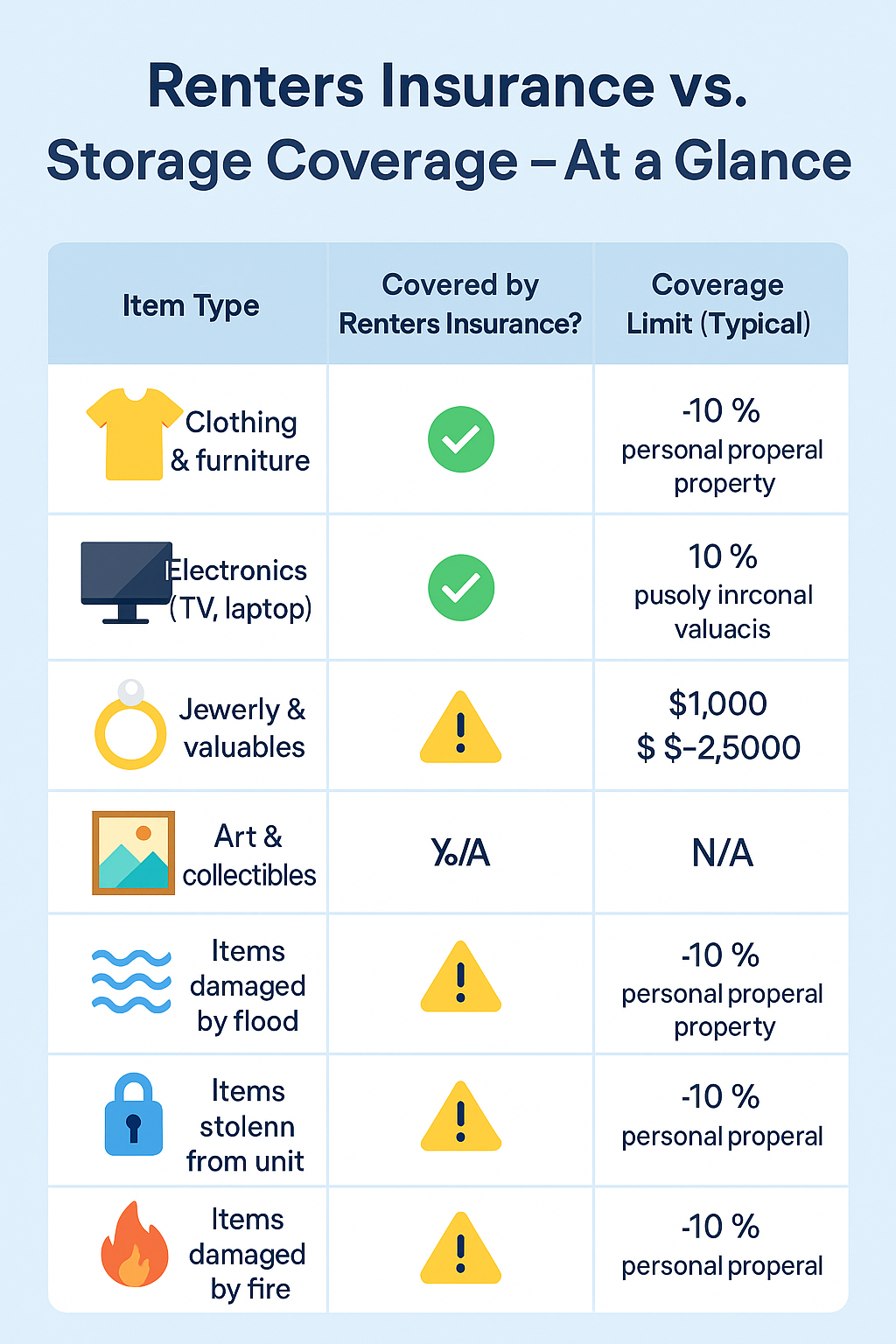

3. Sub-Limits on Specific Valuables

Certain categories have even tighter limits, such as:

Jewelry, watches, cash, and silverware often limited to $200–$2,500

Electronics and business equipment stored off-premises may be capped separately

To fully protect these, you may need to “schedule” individual items or purchase an endorsement.

4. What If Stored Items Exceed the Limit?

If your stored items are more valuable than the covered amount, consider:

Increasing your personal property limit

Adding an off-premises or scheduled property rider

Purchasing storage-specific insurance offered by the storage facility or third-party providers—often covering up to $25,000 per unit and broader perils

5. How to File a Claim Successfully

Tips for a smoother claim process:

Keep a detailed inventory with photos and receipts

Document the event with timestamps and police or incident reports

File the claim promptly and include clear proof of ownership

Confirm the peril is covered—flood and pest damage are not

Summary Table

| Scenario | Covered? | Notes |

|---|---|---|

| Items in storage (standard policy) | Yes | Typically up to 10% of your Coverage C or $1,000 cap |

| Jewelry, cash, collectibles | Sometimes | Subject to stricter sub-limits |

| High-value items beyond limit | No | Requires rider or separate policy |

| Flood, mold, or pest damage | No | Must be insured separately |

| Separate storage insurance | Yes | Higher limits and expanded perils |

Final Takeaway

Renters insurance generally does cover belongings in storage units, but the limit is usually 10% of your personal property coverage or $1,000, whichever is less. For expensive or high-risk items, extra coverage may be necessary.

Need help reviewing your policy or increasing your coverage?

With over 30 years of experience and access to nearly 100 carriers, THAgency will help you find the best policy that covers your stored items—fast, secure, and tailored to your needs.

Renters Insurance quote

Related Posts

Get a Right Insurance For You

SHARE THIS ARTICLE

We will compare quotes from trusted carriers for you and provide you with the best offer.

Whatever your needs, give us a call, have you been told you can’t insure your risk, been turned down, or simply unhappy with your current insurance? Since 1995 we’ve been providing coverage to our customers, and helping people across United States.