The Difference between Life Insurance and Annuities

When forging the blueprint of an all-encompassing, long-term financial strategy, the inclusion of life insurance and annuities emerges not as a mere option, but as a fundamental imperative. With the expert guidance of an independent insurance agent, these intricate financial instruments can be sculpted and molded to intricately fit the unique contours of your family’s financial landscape.

Life Insurance and Annuities: An In-Depth Comparative Analysis

- The Fundamental Pillars: Purpose and Multifaceted Benefits

Life Insurance: At its core, life insurance is a steadfast fortress of protection, strategically erected to shield your family from the unanticipated ravages of your untimely demise. It materializes as a testamentary gift, an unwavering guarantee that your loved ones shall traverse the path ahead with financial poise, empowered to uphold their quality of life, manage debts, and continue pursuing their aspirations, even in your absence.

Annuities: Standing in stark contrast, annuities assume the role of a financial anchor, firmly tethering you to a future of financial security during your twilight years. The bedrock of annuities lies in their ability to counter the daunting prospect of outlasting your painstakingly accumulated savings. By embracing annuities, you chart a course to unfaltering monetary sustenance, fostering a seamless transition from your productive years to a retirement ensconced in economic serenity.

Divergence in Focus: Catalyzing a Death Benefit vs. Insulating Longevity

Life Insurance: A pivot point that demarcates life insurance from annuities lies in their profound focus. The essence of life insurance revolves around ensconcing a death benefit, an indemnity poised to cushion the emotional and financial turmoil that ensues after your passing. This financial cushion bestows your beneficiaries with the means to navigate life’s intricacies, fortified by a lump-sum payout strategically designed to serve as a beacon of stability.

Annuities: In the annuity realm, the spotlight shifts resolutely towards combating the tempestuous tides of longevity. The very core of annuities is a promise to thwart the specter of depleting your financial reserves through the passage of time. Annuities pledge an unbroken stream of income, a lifeline that traverses the entirety of your retirement journey, enabling you to bask in the golden rays of retirement without succumbing to the fear of exhausting your fiscal reservoirs.

Primary Beneficiaries: Enabling Loved Ones vs. Empowering Policyholders

Life Insurance: The intricate tapestry of life insurance is meticulously woven around your designated beneficiaries, the cherished individuals who shall inherit the mantle of your legacy. This sagacious arrangement ensures that your family’s well-being remains impervious, even when you are no longer a tangible presence in their lives.

Annuities: Contrastingly, the fulcrum of annuities tilts toward your own well-being as the policyholder. While annuities might not culminate in a grandiose lump-sum windfall, their paramount goal is the safeguarding of your financial equilibrium through a consistent and dependable income flow, nurturing you through the tapestry of your post-retirement years.

Mitigating Risks: Countering Premature Departure vs. Longevity Uncertainties

Life Insurance: The cloud of premature demise is deftly dispersed through the risk management prowess of life insurance. Your diligent payment of premiums erects a bulwark that envelops your family in a protective cocoon, shielding them from the capriciousness of unforeseen tragedies and guaranteeing their financial prosperity.

Annuities: In the annuity arena, the prime concern centers on the challenge of longevity. Annuity contracts construct a formidable barrier against the erosion of your financial foundations, epitomizing a prudent strategy to stave off the prospect of outliving your wealth during your golden years.

The profound dichotomy between life insurance and annuities unfolds as a cornerstone in the symphony of financial planning. While life insurance orchestrates a harmonious melody of protection for your beneficiaries, annuities conduct a symphony of security, resounding in resolute defense against the uncertainties of outlasting your fiscal resources. The alchemical blend of these two financial instruments, seamlessly tailored to your family’s unique canvas, forges an impervious fortress of financial well-being. In this intricate endeavor, the sage guidance of an independent insurance agent shines as a beacon, illuminating the path toward a harmonious coalescence that ensures the prosperity of both your loved ones and your own golden years.

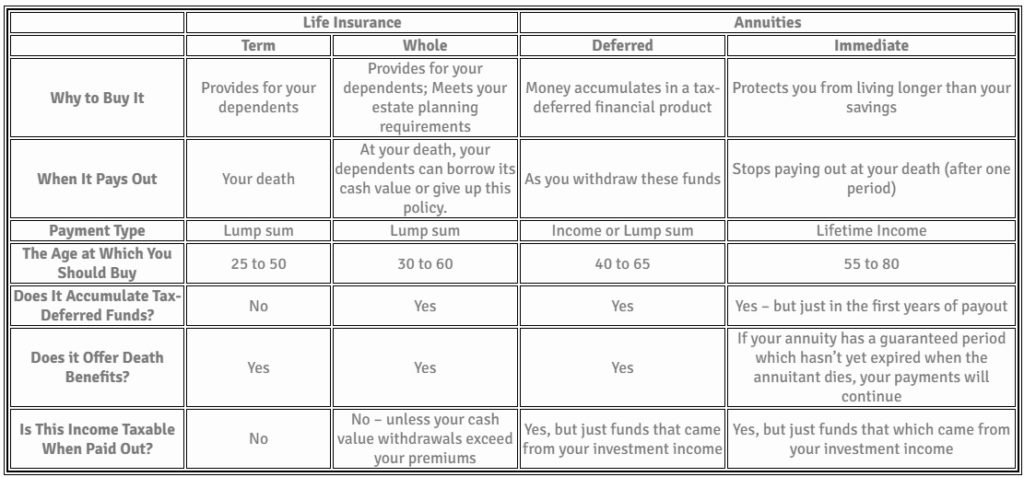

Immediate and Deferred Annuities: Venture into the graphic below, where a comprehensive elucidation of the two primary annuity classifications beckons: immediate and deferred. This illuminating exploration extends to the most prevalent forms of life insurance – whole life and term – casting a spotlight on their nuanced attributes and multifarious functionalities. Embark on this journey of enlightenment and gain a profound understanding of how these financial instruments intertwine to shape your enduring financial legacy.

Related Posts

Get a Right Insurance For You

SHARE THIS ARTICLE

We will compare quotes from trusted carriers for you and provide you with the best offer.

Protecting your future with us

Whatever your needs, give us a call, have you been told you can’t insure your risk, been turned down, or simply unhappy with your current insurance? Since 1995 we’ve been providing coverage to our customers, and helping people across United States.