Understanding Agreed Value in Property Insurance: What It Means and Why It Matters

We will search the top carriers for you for the best offer.

Agreed Value Property Insurance

When it comes to protecting your property, understanding your insurance policy is essential. One important feature to consider is the agreed value clause in property insurance. This approach provides clarity and financial stability, ensuring that you are adequately compensated in the event of a total loss.

What Is Agreed Value?

Agreed value is a valuation method where the insurer and the policyholder agree on a specific value for the insured property at the start of the policy. Unlike other methods, agreed value doesn’t factor in depreciation or market fluctuations when determining the payout for a covered loss.

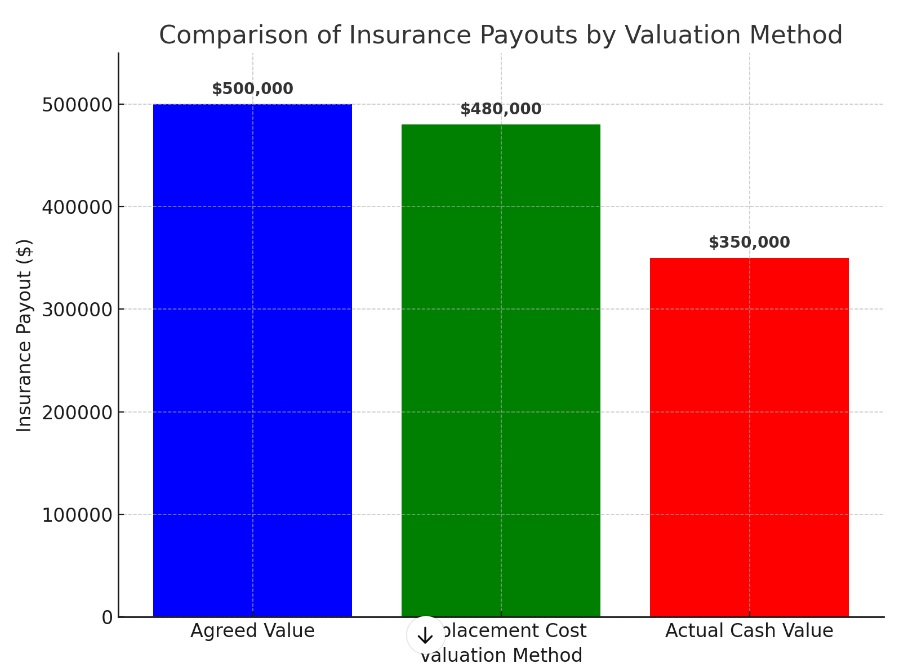

For example, if a property is insured for an agreed value of $500,000 and it suffers a total loss, the insurer will pay the full $500,000 regardless of changes in market conditions or the property’s current value.

Benefits of Agreed Value Policies

Fixed Payout Amount

With agreed value, you know exactly how much you’ll receive in case of a total loss, removing uncertainty and avoiding disputes.No Depreciation Deductions

Unlike policies based on actual cash value, agreed value doesn’t deduct depreciation, ensuring a full payout based on the agreed amount.Simplified Claims Process

The pre-determined amount eliminates negotiations and lengthy assessments, speeding up the claims process.

Agreed Value vs. Other Valuation Methods

| Valuation Method | How It Works | Advantages | Disadvantages |

|---|---|---|---|

| Agreed Value | Pre-set value agreed upon by insurer and insured. | Predictable payout; no depreciation. | May lead to higher premiums. |

| Replacement Cost | Covers the cost to replace the property at current prices. | Ensures full replacement. | Can be more expensive. |

| Actual Cash Value | Replacement cost minus depreciation. | Lower premiums. | Lower payout due to depreciation. |

When Should You Choose Agreed Value?

Unique or Custom Properties

Agreed value is ideal for properties that are difficult to value using standard methods, such as historic buildings or custom-designed homes.High-Value Personal Belongings

Items like fine art, antiques, or expensive jewelry often hold value that isn’t adequately reflected in market prices.Peace of Mind

If you want the reassurance of knowing exactly what you’ll receive after a loss, agreed value provides unmatched clarity.

Considerations Before Choosing Agreed Value

- Higher Premiums: Because agreed value policies often provide broader protection, they can come with higher premiums.

- Careful Valuation: Ensure the agreed value accurately reflects your property’s worth to avoid being over or under-insured.

Conclusion

Agreed value policies offer a straightforward and predictable way to protect your property, ensuring you receive the agreed-upon amount if a total loss occurs. Whether you own a unique property, valuable belongings, or simply want peace of mind, this approach can be an excellent choice for safeguarding your assets.

For maximum protection, evaluate your property’s value carefully and choose coverage that suits your specific needs.

Related Posts

Get a Right Insurance For You

SHARE THIS ARTICLE

Commercial property insurance quote

Send the request and we will quote multiple markets to get you the best coverage and price.

We will compare quotes from trusted carriers for you and provide you with the best offer.

Protecting your future with us

Whatever your needs, give us a call, have you been told you can’t insure your risk, been turned down, or simply unhappy with your current insurance? Since 1995 we’ve been providing coverage to our customers, and helping people across United States.